Student Tax Information

Huron is committed to providing students with the most up-to-date information regarding their finances while attending university.

T2202 Tuition Tax Receipts

- T2202s will be available on your Western Student Center under Finances=> Tax Receipts => My T2202 by the end of February. The forms cannot be accessed on tablets or mobile devices so you have to use a PC. Ensure you have a pdf reader on your browser and the pop-up blocker is temporarily disabled to allow you to print/save your receipt. If you are using a Mac, you need to reboot the computer after adjusting these settings. For further help with access to your account or the tax slip, send an email to regtax@uwo.ca.

T4A Scholarships and Bursaries

- T4As will be mailed out to the address on your Huron Statement by the end of February. For inquiries about your T4A kindly contact Chelsea Mitchell at hurpay@uwo.ca or phone 519.438.7224 ext. 858

Residence Tax Receipts

- We do not issue residence tax receipts as our university is tax exempt. Therefore, the amount that can be claimed for income tax purposes is $25, not the full amount of residence fees paid.

Tax Resources for Students

- Canada Revenue Agency Tax Website: https://www.canada.ca/en/services/taxes/income-tax/personal-income-tax.html

- USC’s Free Income Tax Clinic: http://westernusc.ca/income-tax-clinic/

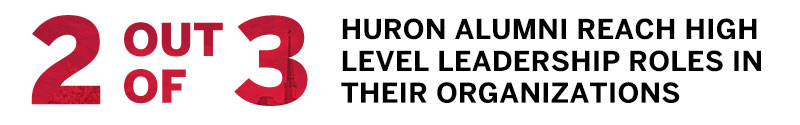

Wes Hall is the Founder and Chairman of Kingsdale Advisors, and The BlackNorth Initiative, and Canada’s first Black Dragon investor on CBC’s Dragons’ Den.

Wes Hall is the Founder and Chairman of Kingsdale Advisors, and The BlackNorth Initiative, and Canada’s first Black Dragon investor on CBC’s Dragons’ Den.

Leigh Allen is the AVP, Global Strategic Research, Reinsurance Group of America Inc., one of the world’s largest global life and reinsurance companies.

Leigh Allen is the AVP, Global Strategic Research, Reinsurance Group of America Inc., one of the world’s largest global life and reinsurance companies. Yola Ventresca is a Managing Partner, Lerners LLP, Secretary of Huron’s Board of Governors and a Huron Class of ’02 alumni. Selected as one of Canada’s “Best Lawyers,” she is passionate about the value of Liberal Arts in helping students succeed in their careers.

Yola Ventresca is a Managing Partner, Lerners LLP, Secretary of Huron’s Board of Governors and a Huron Class of ’02 alumni. Selected as one of Canada’s “Best Lawyers,” she is passionate about the value of Liberal Arts in helping students succeed in their careers.

Lisa Jones Keenan is the Vice President of Sales at Xplornet Communications, the largest rural fixed wireless broadband service provider in Canada.

Lisa Jones Keenan is the Vice President of Sales at Xplornet Communications, the largest rural fixed wireless broadband service provider in Canada.  Ranjita is Executive Chair of the Oxford Global Partnership, advising investors, businesses, family offices and entrepreneurs on sustainable, inclusive and responsible value creation. A Business Fellow at Oxford University’s Smith School, Ranjita engages with companies on pursuing value with values, and teaches a postgraduate “Essentials of ESG & DEI” course.

Ranjita is Executive Chair of the Oxford Global Partnership, advising investors, businesses, family offices and entrepreneurs on sustainable, inclusive and responsible value creation. A Business Fellow at Oxford University’s Smith School, Ranjita engages with companies on pursuing value with values, and teaches a postgraduate “Essentials of ESG & DEI” course. Michael Medline is the President and CEO of Empire Company Limited and Sobeys Inc., a leading Canadian grocery retailer with grocery and ecommerce brands that reach across Canada, including Sobeys, Safeway, IGA, FreshCo, Foodland, Thrifty Foods, Farm Boy, Longo’s and Voilà.

Michael Medline is the President and CEO of Empire Company Limited and Sobeys Inc., a leading Canadian grocery retailer with grocery and ecommerce brands that reach across Canada, including Sobeys, Safeway, IGA, FreshCo, Foodland, Thrifty Foods, Farm Boy, Longo’s and Voilà. Susan Farrow is an Assistant Professor in The Temerty Faculty of Medicine at the University of Toronto and a Founding Partner and Co-Director of The Toronto Institute of Group Studies, an organization offering certified training and education in group leadership.

Susan Farrow is an Assistant Professor in The Temerty Faculty of Medicine at the University of Toronto and a Founding Partner and Co-Director of The Toronto Institute of Group Studies, an organization offering certified training and education in group leadership.  Frank Holmes is CEO and Chief Investment Officer of U.S. Global Investors, as well as a business commentator, philanthropist and Huron Class of ‘78 alumnus. Holmes also serves as the Executive Chairman of HIVE Blockchain Technologies, the first cryptocurrency mining company to go public in 2017.

Frank Holmes is CEO and Chief Investment Officer of U.S. Global Investors, as well as a business commentator, philanthropist and Huron Class of ‘78 alumnus. Holmes also serves as the Executive Chairman of HIVE Blockchain Technologies, the first cryptocurrency mining company to go public in 2017. Caleb Hayhoe is the Founder & Chairman of Flowerdale Group and a Huron Class of ’85 Alumnus. Flowerdale Group is a Hong Kong based family office with a global investment outlook across public markets, real estate and private investment. Hayhoe previously spent over ten years building a global sourcing business together with an exceptional team, and remains committed to entrepreneurialism and helping great ideas become sustainable companies.

Caleb Hayhoe is the Founder & Chairman of Flowerdale Group and a Huron Class of ’85 Alumnus. Flowerdale Group is a Hong Kong based family office with a global investment outlook across public markets, real estate and private investment. Hayhoe previously spent over ten years building a global sourcing business together with an exceptional team, and remains committed to entrepreneurialism and helping great ideas become sustainable companies. Kelly Meighen is an experienced philanthropist and volunteer. In her role as president of the T.R. Meighen Family Foundation, she has created a legacy of volunteerism and philanthropic giving in the areas of youth mental health advocacy, environmental conservation and cultural vibrancy.

Kelly Meighen is an experienced philanthropist and volunteer. In her role as president of the T.R. Meighen Family Foundation, she has created a legacy of volunteerism and philanthropic giving in the areas of youth mental health advocacy, environmental conservation and cultural vibrancy.